When managing debt-linked lawful issues, It can be crucial to make certain all concerned events are correctly notified of lawful proceedings. This is when a process server for debt arrives into play. Process servers specialise in providing legal files relevant to financial debt instances, which include courtroom summons and subpoenas. Their function makes certain that men and women are effectively educated of authorized steps currently being taken against them, which happens to be crucial for the smooth progression of the situation.

Precisely what is a Process Server?

A course of action server is an expert that is accountable for providing lawful documents to persons involved in a authorized circumstance. Within the context of credit card debt selection, a process server for credit card debt ensures that a debtor receives the appropriate legal notifications regarding the financial debt selection process. By serving legal paperwork, the procedure server makes certain that the receiver is aware of the legal action and any impending court docket hearings related to the financial debt.

Approach Server for Credit card debt Selection

Personal debt selection often requires authorized proceedings, and It truly is necessary that debtors are thoroughly notified of the motion being taken. A process server for debt performs a significant job in this by offering files which include court docket summons, judgments, and subpoenas. This official notification makes sure that the debtor is conscious of the proceedings and has the opportunity to answer. Knowledgeable system server can help assurance the shipping and delivery procedure complies Using the regulation, blocking any delays in the situation.

What Hours Can a Process Server Provide You?

One of the more prevalent inquiries people have when using the services of a course of action server is, "What hours can a process server provide you?" The answer is usually that approach servers can serve files at different times, according to the lawful demands and circumstances of the situation. If you are working with financial debt selection or credit card credit card debt, a process server for credit card debt may serve files in the course of conventional enterprise several hours, but they could also provide them at night or on weekends to be sure compliance with the authorized course of action. A reliable method server will Be certain that all rules and laws are followed when making sure well timed delivery.

Why You Need a Method Server in Credit card debt Conditions

In personal debt-related legal matters, it's important to possess the correct legal documentation delivered to all parties concerned. A process server US is crucial to make certain the debtor is appropriately notified on the proceedings. Devoid of right assistance, the courtroom might not be capable of move forward with the case, which could result in avoidable delays and troubles. By choosing a specialist method server, you make certain that the process is taken care of successfully and legally.

Summary

No matter if you happen to be coping with charge card credit card debt, common personal debt assortment, or every other lawful concern, a professional course of action server is crucial to ensure the right delivery of authorized files. A process server for debt or possibly a process server for credit card debt can help be sure that the legal approach is carried out proficiently As well as in accordance Using the legislation. Additionally, comprehension the several hours in the course of which a course of action server can provide you is vital to guarantee well timed delivery. By selecting a responsible process server US, you are able to be assured that the authorized files will be delivered in time and in compliance Along with the regulation.

Rick Moranis Then & Now!

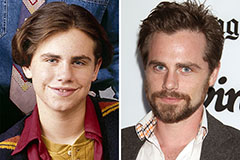

Rick Moranis Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!